Best budgeting apps for managing your money and keep your home life in order

The best budgeting apps can help if you're struggling to stay on top of your finances, keeping your home life and work life together

If you’re struggling with your finances, the best budgeting apps can really help you stay on the financial straight and narrow.

Given smartphones and data plans aren’t exactly cheap, it may feel a bit counterintuitive to use your iPhone or Android handset for money planning. But the best budgeting apps can help you focus on your incomings, outgoings and how much you’re able to set aside for a rainy day.

Once upon a time, making a budget and sticking to it would require a lot of dedication and discipline, with each transaction manually entered. Perhaps a whole day a month in your home office spent working a way on it. Nowadays, the best budgeting apps link to your bank to automatically fill in your incomings and outgoings, so you can easily see where your money is going, and where savings can be made. They typically offer insights on your spending too, so you don’t have to draw the conclusions yourself - this could be one of the smartest ways to reduce bills.

And because our phones are never too far away, it’s never been easier to check in on whether you can afford to pull the trigger on an expensive purchase, whether online or in store.

These are the best budgeting apps you can get at the moment.

The best budgeting apps

YNAB

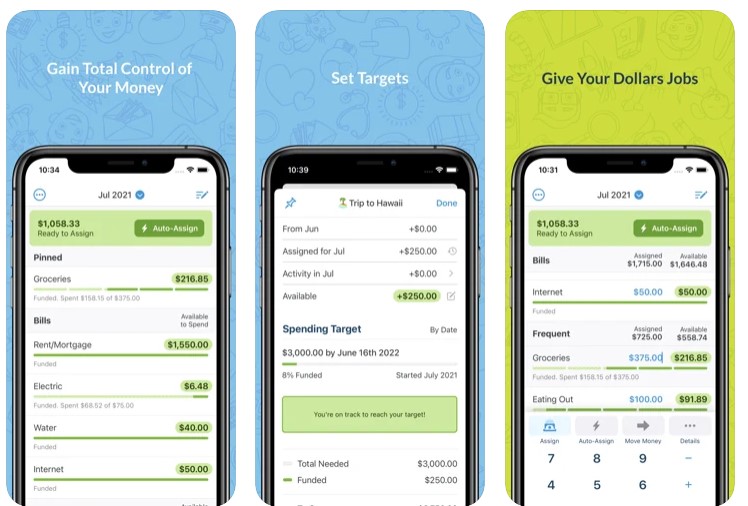

YNAB — or “You Need a Budget” to unpack the acronym — is a great solution for people who really want to get hands-on with their financial decision making. Unlike other budgeting apps, the aim is to help plan future financial goals, rather than to simply track what’s already left your bank account — although it can connect with your bank to do that as well.

It works on a zero-based budgeting system, where every dollar you earn should be allocated to something — be it mortgage, expenses, long-term goals or a savings account. By the end of the month, every dollar should be accounted for, with the ultimate goal of spending last month’s earnings, rather than this month’s.

The Livingetc newsletters are your inside source for what’s shaping interiors now - and what’s next. Discover trend forecasts, smart style ideas, and curated shopping inspiration that brings design to life. Subscribe today and stay ahead of the curve.

Unfortunately it will add an additional expense to your budget — $14.99 a month or $98.99 per year — but YNAB says new budgeters will on average save $600 in their first two months and $6,000 in their first year. You can put this to the test with a 34-day free trial, too.

$14.99 per month | Android | iOS

Goodbudget

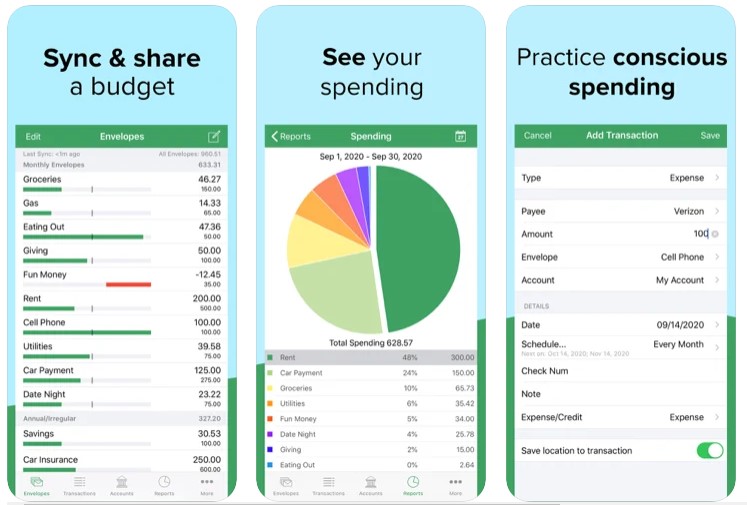

If you like the envelope system seen in YNAB but can’t stomach the cost of it, Goodbudget is an affordable alternative, allowing you to divide up your funds into envelopes with a specific purpose to stay in control of your money.

It has a very capable free version that limits you to 20 envelopes, one account and two devices, but if you need more the full version is competitively priced at just $7 per month or $60 a year.

The downside is that Goodbudget doesn’t link with your bank account, meaning that all outgoings and transactions have to be added manually. Some will prefer that for privacy reasons anyway, and as long as you’re disciplined at frequently updating your expenses, this is just as effective a tool as anything else on the list.

Free / $7.99 per month | Android | iOS

Mint

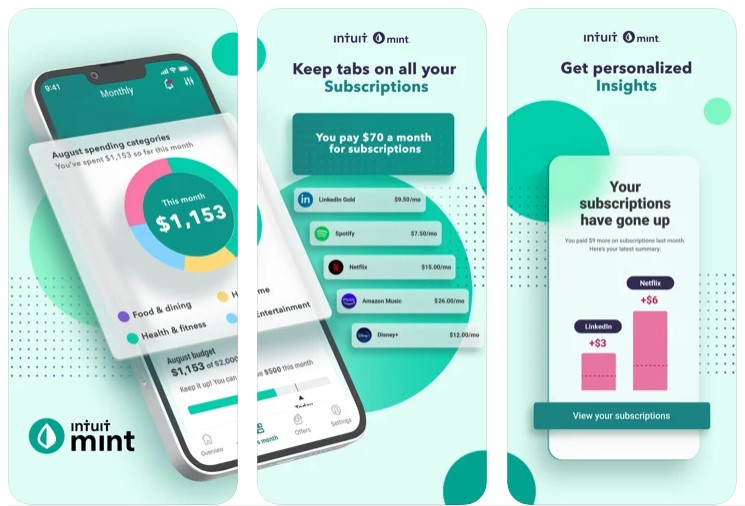

If you prefer not to spend an extra penny on your budgeting efforts, then Mint is for you — which goes a long way to explaining its enduring popularity on both iOS and Android.

The flip side of this is that you may see targeted in-app adverts for financial products you might be interested in, but it’s a small price to pay for the flexibility that Mint offers its 25 million users. It connects with your bank and automatically puts your spending into budget categories, giving you a clear view of what your main outgoings are so you can make adjustments. You can customize this to your liking, and set caps for each category, so Mint can alert you if you’re close to going over your planned spending limits.

There’s also monthly bill tracking, the ability to keep tabs on any investments or loans you have and personalized ‘Mintsights’ where the app will give you insights based on your spending habits. All of this precious information is hidden behind fingerprint protection in the apps for extra privacy, too.

PocketGuard

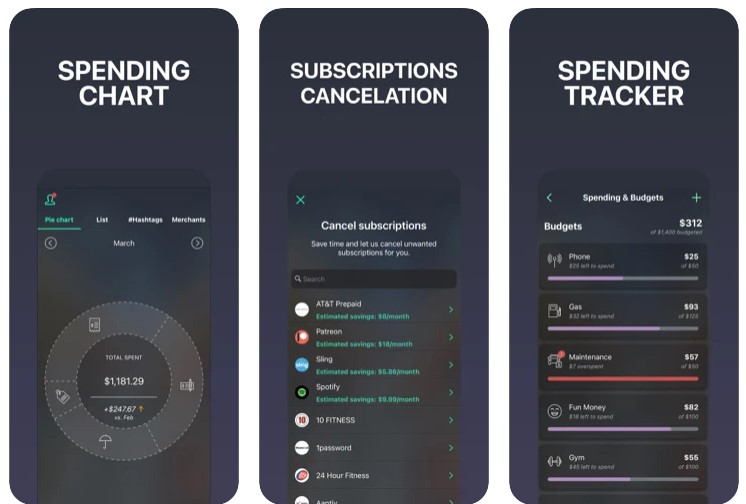

PocketGuard is a good choice for people who want a more hands-off approach that will simply help them get their spending under control. After you’ve connected your bank account and provided your recurring bills, the ‘In My Pocket’ feature algorithmically gives you a quick view of how much money is safe to spend each day, after your typical monthly outgoings and any savings you want to make along the way are factored in.

Speaking of savings, there’s also a handy automated feature which allows you to set a goal and automatically work towards it. If enabled, the app will occasionally move a safe amount of money from your account into an FDIC-insured account to help you achieve your long-term goals without having to actively do it yourself. Though do note this feature will cost you $2 per month if you stick to the free version.

It’s included in the $7.99 per month PocketGuard Plus, which also lets you edit categories, change transaction dates, export data and more. It may not be the most fully featured app here, but it’s simplicity is just the ticket for those who’ve let their financial arrangements become too daunting to get a grip on.

Free / $7.99 per month | Android | iOS

- See the best photo editing apps to help you create gallery wall-ready pics

Honeydue

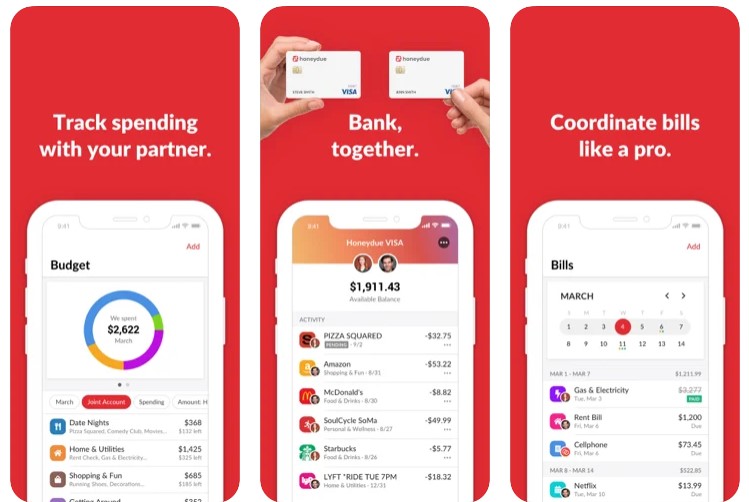

If you and your partner have multiple accounts but shared bills and responsibilities, then Honeydue is the app for you. It allows both partners to sync their bank accounts, credit cards, loans and investments to a shared app for a degree of transparency (though you can adjust how much you reveal as well.)

Like the other best budget apps, it’ll automatically categorize your expenses, allowing you to see where your money is going. Then as a couple, you can put limits on each, with the app sending both parties alerts if you’re coming close to going over budget.

As an alternative, you could also look at Zeta which shares much of the same functionality and focus on couples with shared accounts. It also includes a desktop app if that’s important to you.

Freelance contributor Alan has been writing about tech for over a decade, covering phones, drones and everything in between. Previously Deputy Editor of tech site Alphr, his words are found all over the web and in the occasional magazine too. He often writes for T3 and Tom's Guide. When not weighing up the pros and cons of the latest smartwatch, you'll probably find him tackling his ever-growing games backlog. Or, more likely, playing Spelunky for the millionth time.